Fibonacci retracement is a powerful technical analysis tool used to identify support, resistance, trend continuation, and possible reversals. Traders use it widely in stocks, forex, indices, and crypto to improve entry and exit accuracy.

This article explains:

How to draw Fibonacci retracement in an uptrend for reversal

Fibonacci retracement golden ratio

Fibonacci retracement strategy for intraday

Fibonacci retracement calculator

Best Fibonacci retracement levels

Fibonacci retracement examples

How to Draw Fibonacci Retracement in Uptrend for Reversal

To identify a possible reversal in an uptrend, Fibonacci retracement must be drawn correctly.

Step-by-step process:

- Identify a strong uptrend (higher highs and higher lows)

- Mark the swing High (start of the move)

- Mark the swing low (end of the move)

- Select the Fibonacci retracement tool

- Draw it from swing high to swing low

Once drawn, key Fibonacci levels appear on the chart.

If the price fails to hold important Fibonacci levels, it may signal a trend reversal instead of a pullback.

Reversal clues in an uptrend:

- Price breaks 61.8% retracement decisively

- Strong bearish candlestick near Fibonacci levels

- Breakdown of trendline along with Fibonacci level

- Increase in selling volume

📌 If price breaks and sustains below 78.6%, the uptrend is likely reversing.

Fibonacci Retracement Golden Ratio

The golden ratio (61.8%) is the most important Fibonacci retracement level.

Why 61.8% matters:

- Acts as a strong support in uptrend

- Failure at this level often leads to trend reversal

- Used by institutions and professional traders

Other key ratios related to the golden ratio:

- 38.2% – Shallow pullback

- 50% – Psychological support

- 78.6% – Last support before full reversal

Best Fibonacci Retracement Levels

The most reliable Fibonacci retracement levels are:

- 23.6% – Strong trend continuation

- 38.2% – Healthy correction

- 50% – Balance zone

- 61.8% – Golden ratio (reversal decision zone)

- 78.6% – Deep pullback / reversal level

📌 For reversal trading, focus mainly on:

👉 61.8% and 78.6%

Fibonacci Retracement Strategy for Intraday

Fibonacci retracement works effectively in intraday markets when combined with price action.

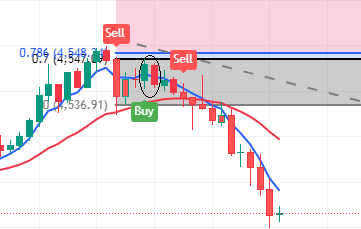

Intraday Reversal Strategy (Uptrend)

- Identify an intraday uptrend

- Draw Fibonacci from low to high

- Watch price reaction near 61.8% or 78.6%

- Look for reversal confirmation:

- Bearish Engulfing / Evening Star

- Volume spike on selling

- Trendline breakdown

- Sell Entry: Below confirmation candle

- Stop Loss: Above recent swing high

- Target: 38.2% or previous support zone

📌 Use 5-minute or 15-minute charts for intraday trading.

Fibonacci Retracement Calculator

A Fibonacci retracement calculator helps traders quickly calculate important levels.

How to use:

- Enter Swing High

- Enter Swing Low

- The calculator displays:

- 23.6%

- 38.2%

- 50%

- 61.8%

- 78.6%

Most platforms like TradingView, MetaTrader, Zerodha Kite already have a built-in Fibonacci tool, making manual calculation unnecessary.

Fibonacci Retracement Examples

Example 1: Uptrend Reversal

- Stock rises from ₹200 to ₹260

- Fibonacci drawn from 200 → 260

- Price breaks 61.8% with strong volume

- Retest fails at 50%

- Trend reverses into downtrend

Example 2: Intraday Reversal Trade

- BANKNIFTY shows strong morning rally

- Price retraces and breaks 78.6%

- Bearish candle with high volume forms

- Short trade gives quick intraday profit

These examples show how Fibonacci retracement helps identify early reversal signals.

Final Words

Fibonacci retracement is not just a pullback tool—it is also very useful for spotting trend reversals, especially when combined with volume, trendlines, and candlestick patterns.

Key Takeaways:

- Draw Fibonacci low to high in uptrend

- 61.8% is the golden reversal level

- Use confirmation for intraday trades

- Avoid trading Fibonacci alone

You may Like

- How To Identify Bearish Harami Candlestick Pattern

- Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

- Shooting Star Candlestick Pattern: Bullish or Bearish? Complete Guide

- How to Trade the Hanging Man Candlestick Pattern (Bearish & Red Hanging Man Explained)

- Fibonacci Retracement: How to Draw It in Uptrend for Reversal & Intraday Trading

- How To Identify Bearish Harami Candlestick Pattern

- Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

- Shooting Star Candlestick Pattern: Bullish or Bearish? Complete Guide

- How to Trade the Hanging Man Candlestick Pattern (Bearish & Red Hanging Man Explained)

Q1. How to use Fibonacci retracement for reversal?

Ans To use Fibonacci retracement for reversal, draw Fibonacci from the swing high to swing low in an uptrend (or high to low in a downtrend). Watch the 61.8% and 78.6% levels. If price breaks and closes below these levels with strong volume and bearish candlestick confirmation, it signals a possible trend reversal rather than a normal pullback.