Candlestick patterns are powerful tools for technical traders, and among the most reliable reversal signals is the Hanging Man candlestick pattern. This single-candle pattern often warns traders that the ongoing uptrend may be weakening and a bearish reversal could be near.

In this article, you will learn:

- What is a Hanging Man candlestick pattern

- How the bearish Hanging Man works

- How to trade the red Hanging Man

- Entry, stop-loss, and target rules

- Common mistakes to avoid

Let’s get started.

What Is the Hanging Man Candlestick Pattern?

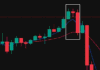

The Hanging Man is a bearish reversal candlestick that appears at the top of an uptrend.

It has:

- A small real body

- A long lower shadow (at least 2× the body size)

- Little or no upper wick

It looks similar to a hammer but forms at the top, not the bottom.

What the Pattern Indicates

The long lower wick shows that sellers tried to push the price down strongly.

Although buyers managed to pull the price back near the open, the selling pressure signals weakness in the uptrend.

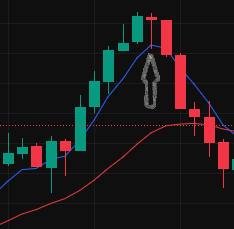

Bearish Hanging Man Candlestick Pattern

A Hanging Man is considered bearish only when:

- It appears after a clear uptrend

- The candle closes weak

- The next candle confirms the reversal (closing below the Hanging Man low)

It’s not enough for the pattern to appear.

Confirmation candle is the key to a high-probability trade.

Why It’s Bearish

- Sellers enter aggressively (long lower shadow)

- Buyers lose control

- Weak close indicates momentum shift

Once the next candle breaks below the Hanging Man’s low, the trend usually starts reversing downward.

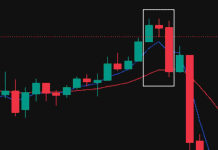

Red Hanging Man Candlestick Pattern

A red Hanging Man is simply the same pattern but with a bearish (red) candle body.

This makes the pattern stronger because:

- The candle closes lower than it opened

- Sellers dominate the session

- Reversal probability increases compared to a green Hanging Man

Red Hanging Man = Stronger Bearish Signal

How to Trade the Hanging Man Candlestick Pattern

Here is a simple, beginner-friendly trading strategy:

✅ Step 1: Identify a Strong Uptrend

The pattern is valid only in an uptrend.

Check higher highs and higher lows on the chart.

✅ Step 2: Spot the Hanging Man Candle

Look for:

- Small real body

- Long lower shadow (2× the body)

- Very small upper shadow

If it forms at resistance, supply zone, or previous swing high, the pattern becomes more reliable.

✅ Step 3: Wait for Confirmation Candle

This is the MOST important rule.

A bearish confirmation candle should:

- Close below the Hanging Man’s low

- Show strong red body

- Increase in volume (optional but helpful)

Never enter without confirmation.

✅ Step 4: Entry Rule

Enter a sell (short) trade:

- Below the low of the Hanging Man

OR - On the confirmation candle’s close

This keeps you on the safe side.

✅ Step 5: Stop-Loss Placement

Place your stop-loss:

- Above the high of the Hanging Man candle

OR - Above the nearest resistance zone

This protects you from false breakouts.

✅ Step 6: Take-Profit Levels

You can target:

- Recent swing lows

- Fibonacci retracement levels (38.2% or 61.8%)

- Support zones

- 1:2 or 1:3 risk-reward ratio

Example of a High-Probability Hanging Man Trade

- Market is in a strong uptrend

- A Hanging Man forms at resistance

- Next candle breaks below its low

- You enter short

- Stop-loss above the pattern high

- Exit at support zone

This simple approach works well in stocks, forex, crypto, and indices.

Common Mistakes Traders Make

❌ Trading the Hanging Man without an uptrend

❌ Entering without confirmation

❌ Using a small stop-loss

❌ Ignoring market structure

❌ Trading Hanging Man inside consolidation

Avoid these mistakes for better accuracy.

Final Thoughts

The Hanging Man candlestick pattern is a powerful bearish reversal signal when used correctly.

A red Hanging Man provides even stronger selling pressure, but confirmation is necessary before taking any trade.

This pattern works best when combined with:

- Support and resistance

- Volume

- Trendline analysis

- Moving averages

- Market structure

Mastering the Hanging Man can improve your trading accuracy and help you catch trend reversals early.

Also Read

Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

Shooting Star Candlestick Pattern: Bullish or Bearish? Complete Guide

How to Trade in Bullish Hammer Candlestick Pattern: Meaning, Psychology

How to Trade in a Symmetrical Chart Pattern

- Fibonacci Retracement: How to Draw It in Uptrend for Reversal & Intraday Trading

- How To Identify Bearish Harami Candlestick Pattern

- Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

- Shooting Star Candlestick Pattern: Bullish or Bearish? Complete Guide

- How to Trade the Hanging Man Candlestick Pattern (Bearish & Red Hanging Man Explained)

Q1. Is a Hanging Man bullish or bearish?

Ans A Hanging Man is a bearish reversal candlestick pattern. It forms at the top of an uptrend and signals that the ongoing bullish momentum may be weakening. Even if the price closes slightly higher or forms a green candle, the long lower shadow shows strong selling pressure during the session. This indicates that buyers are losing control and a potential downward trend may begin if the next candle confirms the reversal.

In short, the Hanging Man is bearish, not bullish.

Q2. How to Confirm a Hanging Man?

Ans A Hanging Man becomes a reliable bearish reversal signal only after confirmation.

To confirm the pattern, traders look for bearish action in the next candle.

Here’s how to confirm it:

✅ 1. The next candle must close below the Hanging Man’s low

This is the strongest confirmation.

It shows that sellers have taken control after the pattern forms.

✅ 2. A strong red (bearish) candle after the Hanging Man

A large red candle with solid volume reinforces the reversal signal.

✅ 3. Breakdown of support or trendline

If the price breaks below a nearby support level or trendline, the bearish confirmation becomes stronger.

✅ 4. Higher volume on the Hanging Man or the confirmation candle

Increased volume indicates real selling pressure, not just a temporary dip.

⚠️ Without these confirmations, a Hanging Man is not a valid reversal, and the uptrend may continue.