Candlestick patterns are powerful tools for traders who want to understand market psychology. Among them, the Shooting Star candlestick pattern is one of the most reliable signals of a possible trend reversal.

In this article, you will learn:

- Is the Shooting Star pattern bullish or bearish?

- Shooting Star candlestick pattern at the top

- Shooting Star pattern in an uptrend

- How to trade it effectively

What Is a Shooting Star Candlestick Pattern?

A Shooting Star is a single-candle bearish reversal pattern.

It appears after an uptrend and indicates that buyers are losing control while sellers are entering strongly.

Key Features of a Shooting Star:

- Small real body (red or green)

- Long upper shadow (wick should be at least twice the body size)

- Very small or no lower shadow

- Appears after a strong upward move

This candle looks like a “star falling from the sky,” which is why it’s called a Shooting Star.

Shooting Star Candlestick Pattern – Bullish or Bearish?

The Shooting Star is a bearish reversal pattern, not bullish.

It signals selling pressure at higher levels and warns that the uptrend may be ending soon.

Why bearish?

- Price opens higher

- Buyers push price further up

- Sellers quickly step in and push price down near the open

- This shows rejection of higher prices

Because of this strong rejection, the Shooting Star is considered bearish.

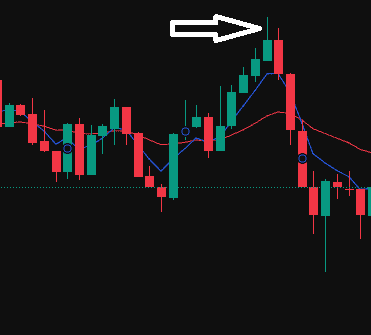

Shooting Star Candlestick Pattern at the Top

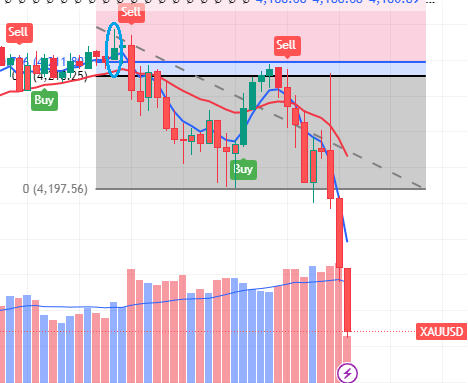

The Shooting Star is most powerful when it appears at the top of an uptrend or near a resistance zone.

Why Shooting Star at the Top is Important?

- Market is already overbought

- Buyers have exhausted

- Huge wick shows strong rejection

- Sellers are preparing to reverse the trend

If this candle forms at the top:

✔️ Trend reversal probability increases

✔️ Traders prepare for short (sell) setups

✔️ Buying pressure weakens sharply

This is the classic and most reliable form of the Shooting Star.

Shooting Star Candlestick Pattern in an Uptrend

The Shooting Star pattern should only be trusted when it forms during an uptrend.

What It Means in an Uptrend:

- Uptrend is losing momentum

- Bulls are unable to sustain higher levels

- Demand is weakening

- Potential change-of-trend or short-term correction coming

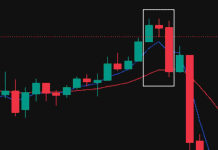

However, confirmation candle is important.

Confirmation After Shooting Star:

- Next candle should close below the Shooting Star’s body

- A red candle gives stronger confirmation

- Volume increase adds more reliability

Without confirmation, the signal becomes weak.

How to Trade Shooting Star Candlestick Pattern (Simple Strategy)

1. Identify the Uptrend

The market must be moving upward before the Shooting Star appears.

2. Wait for the Shooting Star to Form

Check for:

- Long upper shadow

- Small body

- Appearing at resistance or top

3. Wait for Confirmation Candle

Enter a sell trade only after the next candle closes lower.

4. Entry Point

Sell below the low of the confirmation candle.

5. Stop Loss

Place stop loss above the Shooting Star’s high.

6. Target

You can target:

- Previous support

- Demand zone

- Or use 1:2 / 1:3 risk-reward ratio

Common Mistakes Traders Make

❌ Entering the trade without waiting for confirmation

❌ Trading Shooting Star in a sideways or downtrend

❌ Ignoring volume and support-resistance zones

❌ Using it alone without other indicators

Final Words

The Shooting Star candlestick pattern is a powerful bearish reversal signal.

It becomes most effective when it forms at the top of an uptrend, especially near resistance.

To trade it successfully:

- Identify the uptrend

- Wait for the Shooting Star

- Confirm with the next candle

- Use proper stop loss and risk management

Mastering this pattern can help you avoid false breakouts and catch trend reversals early.

Also Read

- Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

- How to Trade the Hanging Man Candlestick Pattern (Bearish & Red Hanging Man Explained)

- How to Trade in Bullish Hammer Candlestick Pattern: Meaning, Psychology

- How to Trade in a Symmetrical Chart Pattern

- Fibonacci Retracement: How to Draw It in Uptrend for Reversal & Intraday Trading

- How To Identify Bearish Harami Candlestick Pattern

- Bearish Evening Star Candlestick Pattern: Meaning, Identification & Trading Guide

- Shooting Star Candlestick Pattern: Bullish or Bearish? Complete Guide

- How to Trade the Hanging Man Candlestick Pattern (Bearish & Red Hanging Man Explained)

Q1. How Do You Confirm a Shooting Star Candlestick?

Ans To confirm a Shooting Star candlestick pattern:

1. Check the uptrend – The pattern must appear after a bullish move.

2. Identify the candle – Small body, long upper wick, and little to no lower shadow.

3. Wait for confirmation – The next candle must close below the Shooting Star’s body.

This shows sellers have taken control and confirms the bearish reversal.

A strong volume on the confirmation candle makes the signal even more reliable.

Q2. What Is the Success Rate of the Shooting Star Pattern?

Ans The Shooting Star candlestick pattern has a moderate success rate. When the candle appears after a strong uptrend and is supported by volume or a resistance zone, it predicts a short-term price drop about 55–60% of the time.

Its small body near the low, long upper wick, and rejection of higher prices make it a useful—but not perfect—bearish reversal signal. Always use confirmation and proper risk management for higher accuracy.